Union Home and Cooperation Minister Amit Shah has called on Indian banks to elevate their ambitions, aiming to position themselves among the world’s top ten financial institutions.

Speaking at the Financial Express Best Banks Awards in Mumbai on September 25, Shah emphasized the critical role of banks in supporting micro, small, and medium enterprises (MSMEs), which he identified as the backbone of India’s economic growth.

Shah noted that many of India’s largest conglomerates, including Reliance Industries, Adani Group, and Torrent Group, began as MSMEs. He stressed that neglecting this sector would impede the nation’s economic progress.

The government has introduced various initiatives to support MSMEs, such as the Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE), which provides collateral-free credit to these businesses.

“Over the years, we have strongly enforced ease of doing business where 40,000 compliances have been removed. Efforts have been taken to tackle criminalisation and corruption which was rampant in the past through introducing penalty and action. We are shortly moving forward to Jan Vishwas Bill 2 with zero criminal economy,” he said.

Highlighting the government’s commitment to financial inclusion, Shah pointed out that over 530 million bank accounts have been opened since 2014, providing access to banking services for previously underserved populations. He also mentioned that approximately 86 key reforms have been implemented to strengthen the banking sector, making it more resilient and robust.

Shah’s remarks underscore the government’s vision of transforming India into a global economic leader by 2047. He urged banks to align with this vision by scaling up their operations and focusing on inclusive growth.

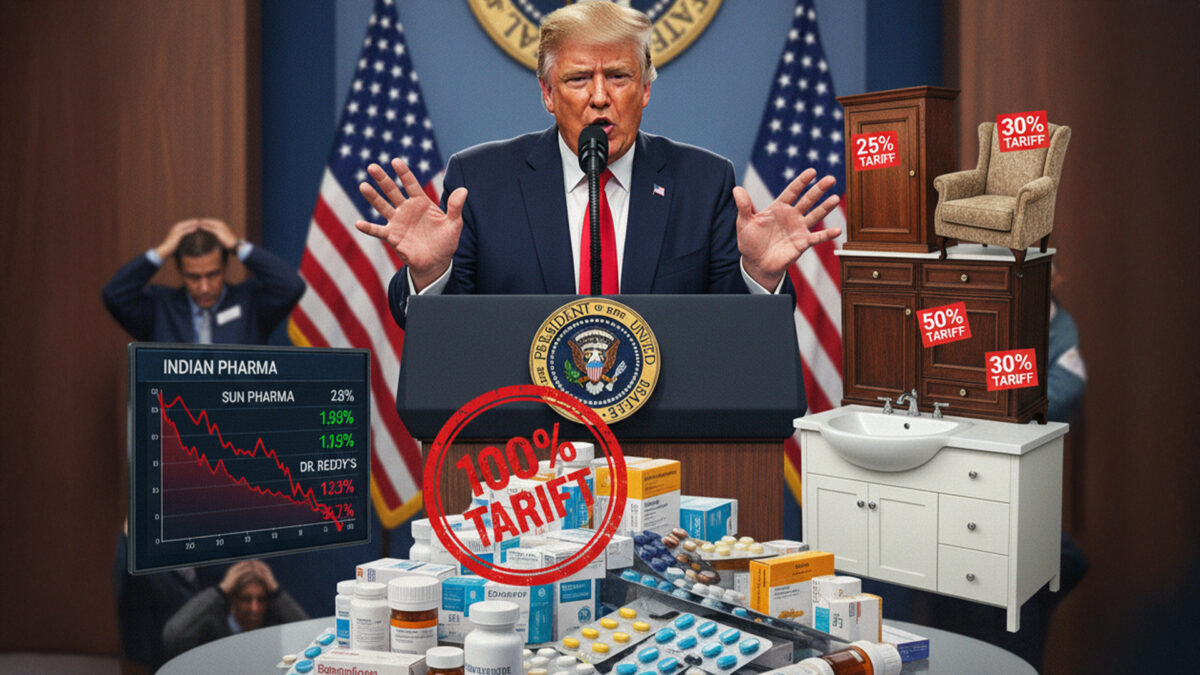

Also Read: US to Probe Waaree Energies Over Alleged Solar Tariff Evasion