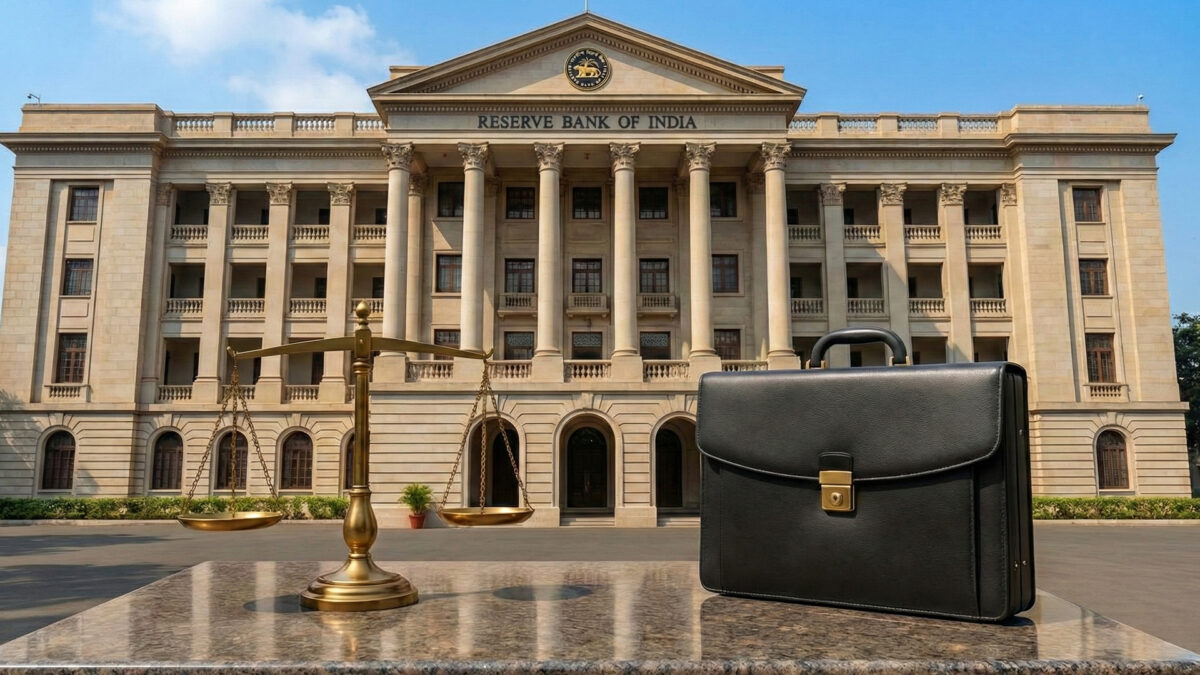

The Reserve Bank of India (RBI) on February 6, 2026, decided to keep the key policy repo rate unchanged at 5.25%, maintaining a cautious approach as inflation remains under control and economic growth stays steady. The decision was taken by the Monetary Policy Committee (MPC) at the end of its bi-monthly review meeting.

Along with the rate pause, the MPC also chose to retain its ‘neutral’ policy stance, signalling that future interest rate decisions will be guided by incoming economic data rather than a fixed bias towards tightening or easing. This means the RBI is keeping its options open amid both domestic stability and global uncertainties.

RBI Governor Sanjay Malhotra said inflation has eased significantly from earlier highs and is now comfortably within the central bank’s target range. Lower food prices, improved supply conditions, and softer global commodity prices have helped contain price pressures. However, the RBI cautioned that risks from unpredictable weather, global energy prices, and geopolitical tensions still remain.

On the growth front, the central bank expressed confidence in India’s economic momentum. It noted that domestic demand remains strong, supported by healthy consumption, rising investment activity, and robust performance in the services sector. Manufacturing activity has also shown signs of improvement, aided by government capital expenditure and stable financial conditions.

The RBI slightly upgraded its growth outlook, reflecting optimism about India’s medium-term prospects, even as global economic conditions remain uneven. At the same time, the MPC stressed the need for vigilance, especially as global financial markets continue to react to policy signals from major central banks.

Also Read: US drops 25% tariff on Indian goods