IndusInd Bank has appointed Arijit Basu, former Managing Director of the State Bank of India (SBI), as its new Part‑Time Chairman and Non‑Executive Independent Director, effective January 31, 2026. His term will run for three years, subject to shareholder approval and regulatory compliance.

Basu succeeds Sunil Mehta, whose term ends on January 30, 2026. Mehta, who has led the board since January 2023, opted not to seek reappointment. The transition has been approved by the bank’s board and the Reserve Bank of India (RBI).

Before joining IndusInd Bank, Basu was Chairman of HDB Financial Services, the non‑banking finance subsidiary of HDFC Bank, a role he resigned from to take up the new position. Basu’s career spans several decades in banking and financial services, including leadership roles as MD of SBI and CEO of SBI Life Insurance Company.

He holds a master’s degree from the University of Delhi and professional banking qualifications, and currently serves on multiple corporate boards and as an advisor to international financial firms. His appointment is expected to strengthen the bank’s governance and strategic oversight.

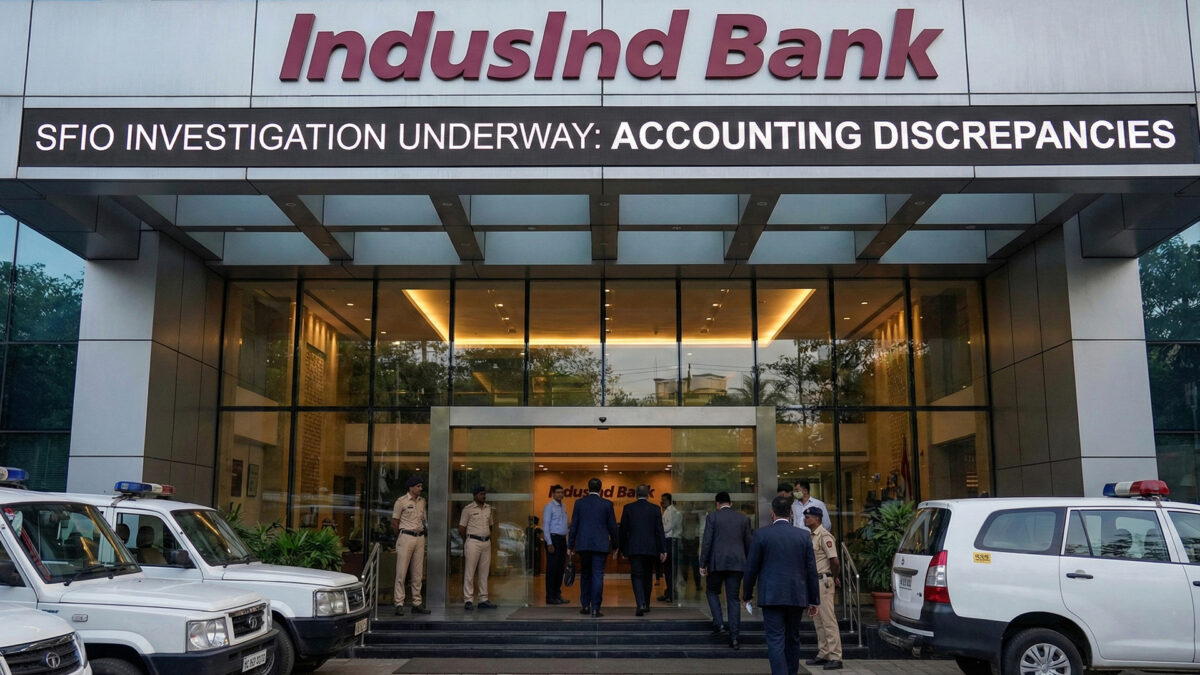

The move comes at a critical juncture for IndusInd Bank, which has faced financial pressures and regulatory scrutiny following accounting irregularities disclosed in 2025. The lender reported a 91% year‑on‑year decline in net profit, falling to ₹128 crore in the December quarter, due to higher provisions and lower interest income.

Basu’s appointment is seen as a step to restore stakeholder confidence, enhance governance, and guide the bank through restructuring efforts. IndusInd Bank has stated that Basu is fully eligible to hold directorship without regulatory disqualifications.

Industry experts note that his extensive experience across banking, insurance, and corporate governance positions him well to help IndusInd navigate its current challenges while focusing on long-term growth. With Basu at the helm, the bank aims to stabilize operations, improve investor trust, and reinforce its strategic direction in India’s competitive banking sector.