India is in negotiations with the United States to purchase corn for ethanol production, according to an Economic Times Report, aiming to bolster its biofuel sector and strengthen bilateral trade relations.

This move is part of broader discussions to finalize a comprehensive trade agreement by autumn 2025.

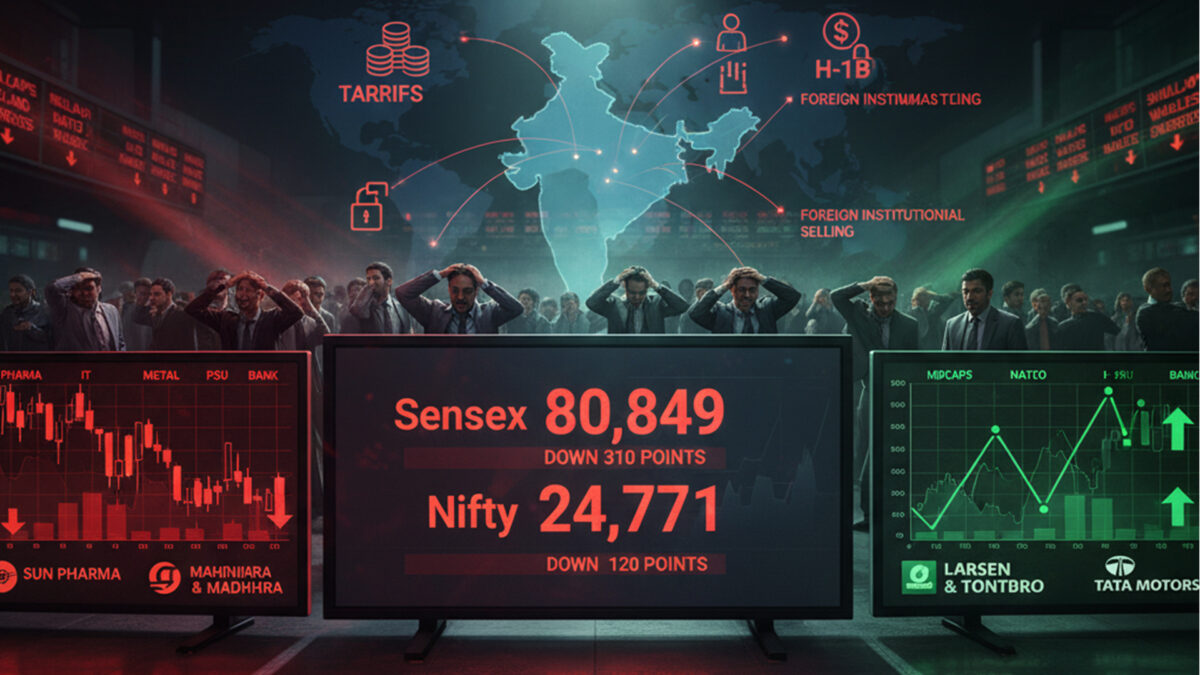

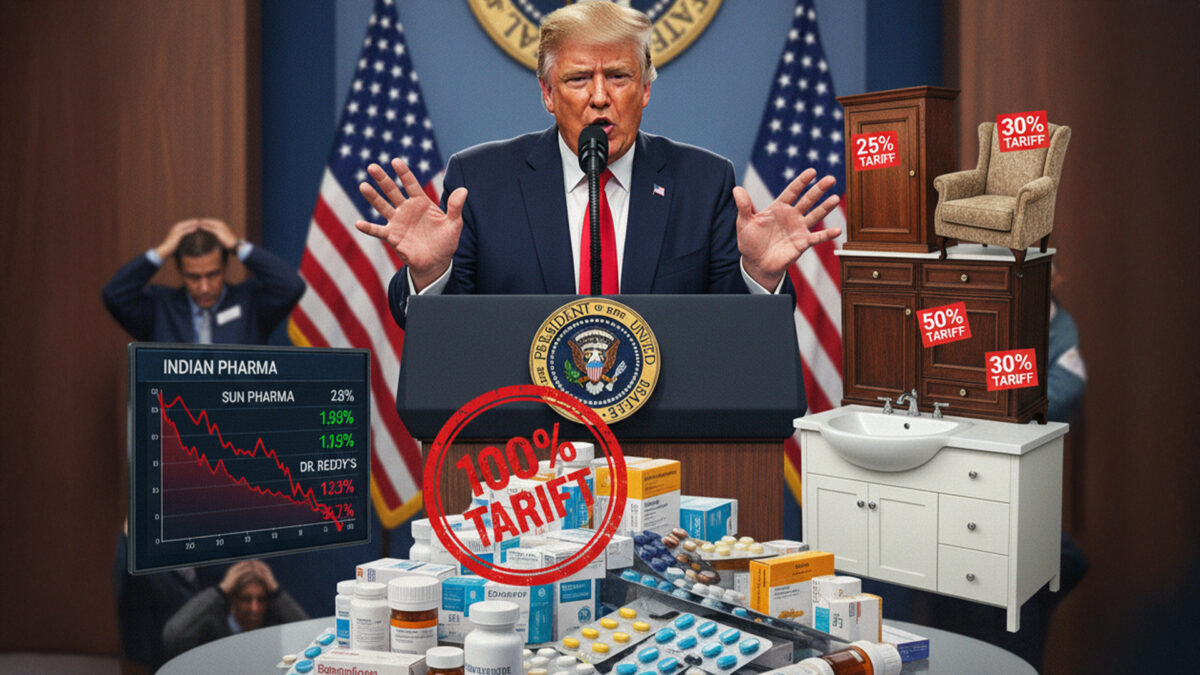

The U.S. has imposed a 25% punitive tariff on Indian imports, citing India’s continued purchase of Russian oil, which Washington argues indirectly funds the war in Ukraine.

In response, India is seeking the removal of these tariffs and offering to increase energy imports from the U.S., including the purchase of American corn for ethanol production.

Ethanol blending is a key component of India’s strategy to reduce crude oil dependence and lower emissions.

However, India faces challenges in accepting U.S. corn imports due to concerns over genetically modified (GM) crops.

The Indian government is cautious about opening its markets to GM products, which could impact domestic agriculture and public acceptance.

To address these concerns, India is considering a self-certification mechanism, where U.S. exporters would provide documentation confirming that their corn is GM-free.

Agriculture remains a sensitive issue in trade negotiations, with India emphasizing the protection of its farmers and food security.

While India has agreed to import certain U.S. agricultural products for animal feed, it remains cautious about broader market access for GM crops.

The U.S. is seeking greater market access for American agricultural products, including corn, soybeans, and ethanol, as part of the trade discussions.

The negotiations are ongoing, with both countries aiming to reach a mutually beneficial agreement that addresses economic and geopolitical interests.

The outcome of these discussions will have significant implications for U.S.-India trade relations and the global agricultural market.

Also Read: IndusInd Bank: Ex-CFO Alleges ₹2,000 Crore Accounting Fraud