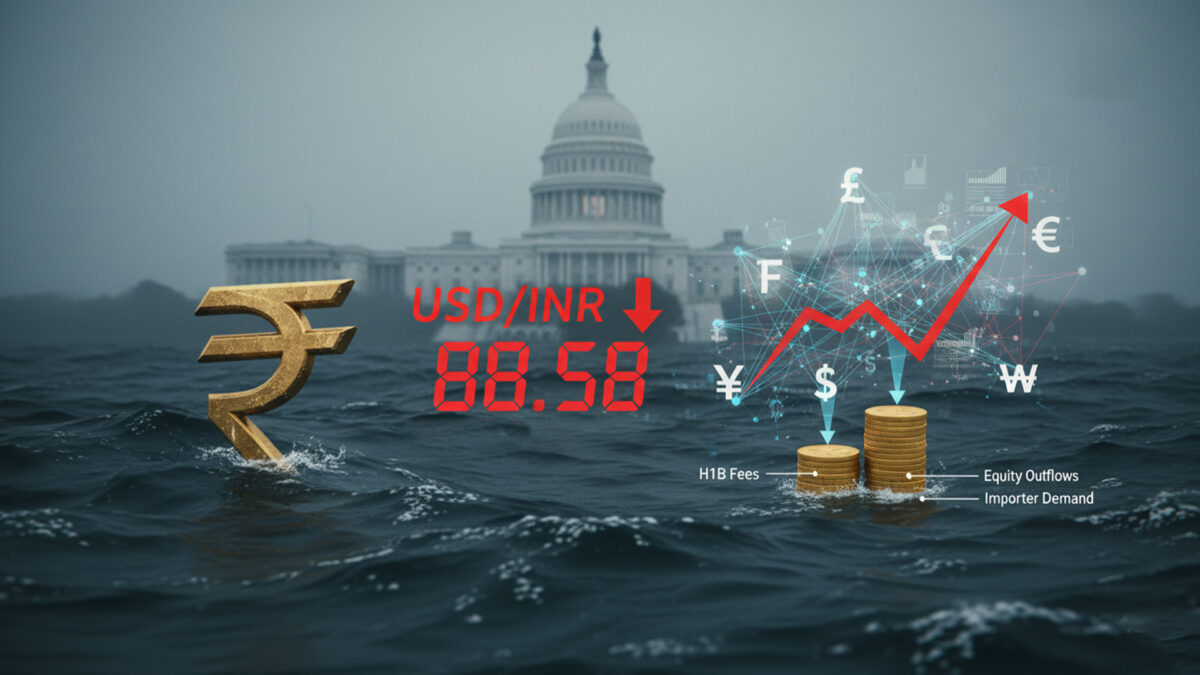

The Indian rupee hit a record low of ₹88.58 against the US dollar in early trade on September 23, following a weak opening and pressure from both domestic and international fronts. The currency had opened at ₹88.4137 against the greenback, compared with ₹88.3163 at the previous close.

Asian currencies broadly were under strain, with the South Korean won down about 0.22 percent, the Thai baht 0.16 percent, the Indonesian rupiah 0.08 percent and the Singapore dollar, Japanese yen and Hong Kong dollar each about 0.05 percent weaker. Analysts say these wider currency trends have exacerbated the rupee’s fall.

Experts point out multiple factors weighing on the rupee, including enhanced US tariffs on Indian goods and a steep hike in H1B visa fees. The move on visa fees—raised to US$100,000 for certain categories—has stirred anxiety among India’s IT and outsourcing sectors. Concerns are rising about reduced remittances and the risk of equity outflows as foreign investors reassess exposure in view of these policy changes. Foreign inflows into Indian equities have already been weak this year.

In commentary on the outlook, currency specialists suggest that despite current pressure, there may be limited room for further sharp depreciation if certain support levels hold. One such expert believes that “the rupee is likely to appreciate from current levels, with support around ₹87.90–88.00,” arguing that if these zones are maintained, the currency could avoid sliding further in the near term.

In addition to policy-induced risks, importers’ demand for the dollar to hedge against rising costs has added to demand pressure. Weak domestic equity markets, and subdued foreign portfolio inflows, further reduce support for the rupee. Traders and analysts are also watching US interest-rate policy closely: higher US yields tend to strengthen the dollar, making it costlier for other currencies, including the rupee.

While the drop to the all-time low underscores the intensity of current pressure, there are signals of possible intervention from the Reserve Bank of India if the rupee weakens significantly further. Such intervention has in past episodes helped stem sharp slides. Ultimately, whether the rupee stabilizes will depend on whether external pressures ease, foreign capital revives, and trade-policy frictions are addressed.

Also Read: Internal Strife Erupts at Tata Trusts Over Nominee Director Appointment