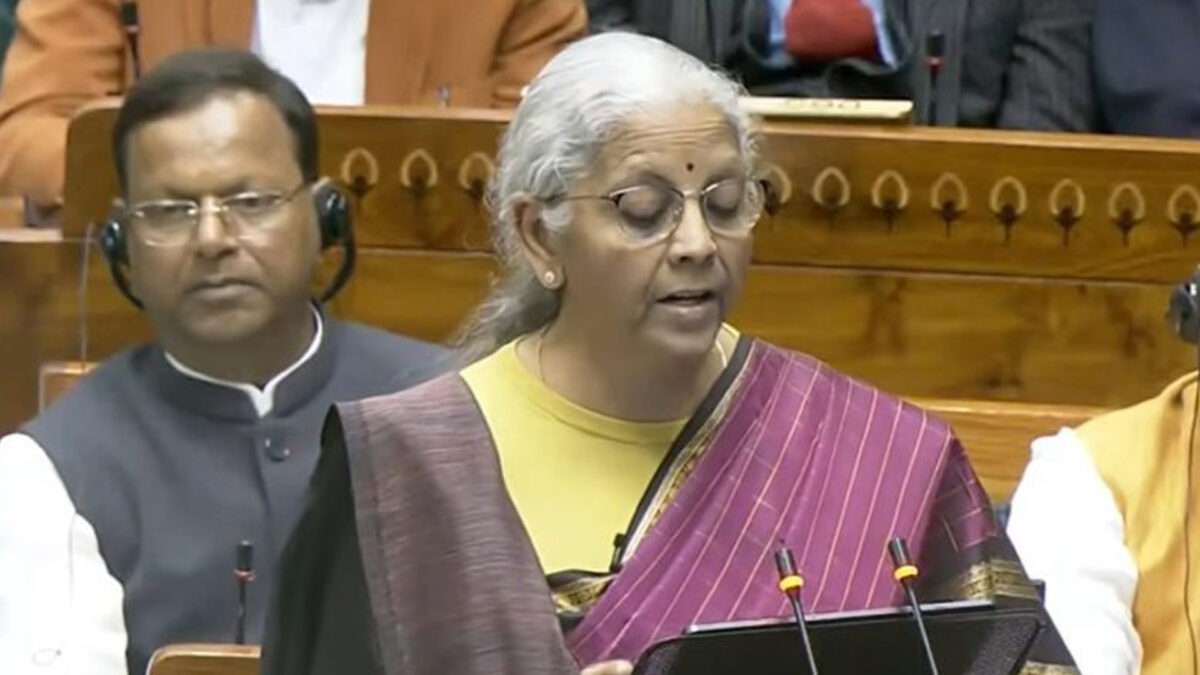

In her Union Budget 2026–27 speech, Finance Minister Nirmala Sitharaman announced the formation of a High-Level Committee on Banking for Viksit Bharat. The panel will conduct a comprehensive review of India’s banking sector and align it with the country’s long-term economic vision, especially towards 2047, the centenary of independence.

Sitharaman highlighted that India’s banks have made significant progress, demonstrating strong balance sheets, record profitability, better asset quality, and extensive financial coverage across the population. These achievements provide a solid foundation for further reforms.

The committee will focus on the banking sector’s structure, governance framework, credit delivery, technological adoption, risk management, and financial inclusion. Ensuring consumer protection while maintaining stability is also a priority.

The minister stressed that the panel’s recommendations will help design a reform roadmap for banks capable of supporting a larger, technology-driven economy, guiding future policy and regulatory decisions.

The budget also includes measures for non-banking financial companies (NBFCs), which are crucial in providing credit to underserved segments. It proposes restructuring major public sector NBFCs, including the Power Finance Corporation and Rural Electrification Corporation, to boost efficiency and scale.