PhysicsWallah, the Indian edtech platform, reported a sharp increase in its quarterly results for Q2 FY26, with net profit rising by nearly 70% to ₹69.71 crore from ₹41.10 crore in the same quarter last year. The strong performance comes as the company continues to expand both online and offline learning offerings.

Revenue for the quarter rose 26.3% to ₹1,051.2 crore, up from ₹832.2 crore in Q2 FY25. The company’s EBITDA margin improved to 26% from 23% a year ago, reflecting operational efficiencies and better cost management.

PhysicsWallah’s paid user base also grew significantly. The number of unique paid users increased from 2.99 million to 3.62 million during the first half of FY26. Of these, 3.22 million enrolled online while 0.40 million joined offline centres. The company now operates 314 offline centres across India, strengthening its hybrid learning model.

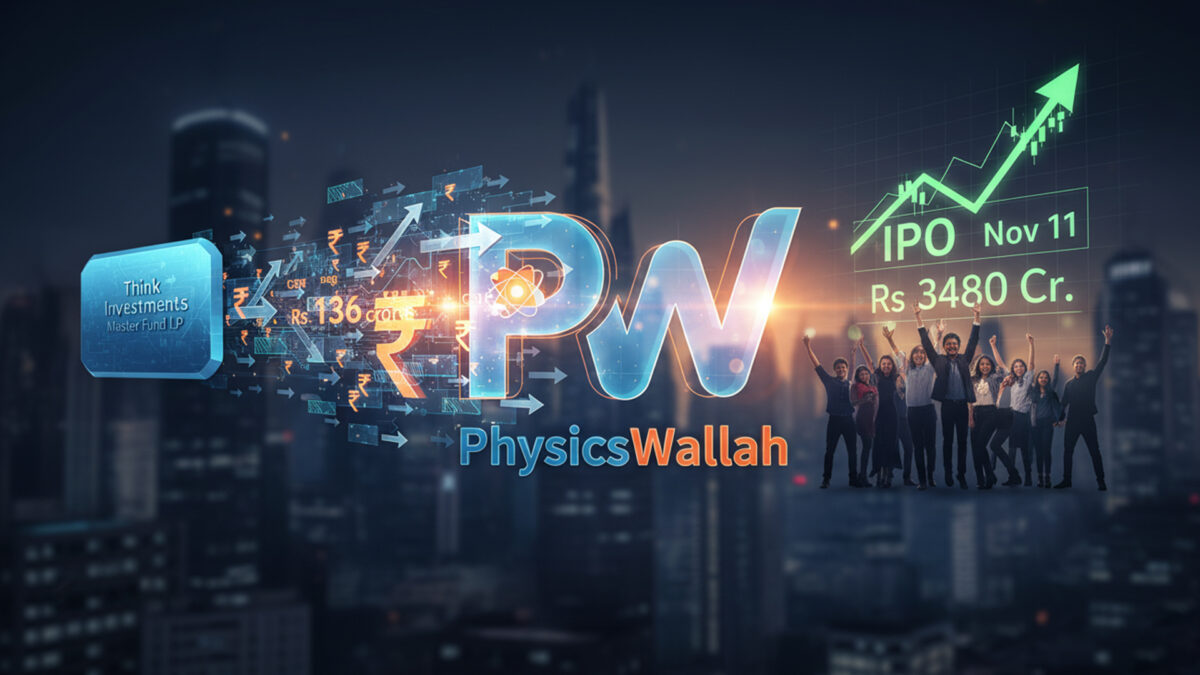

Investors reacted positively to the quarterly results, with the company’s shares rising 5% intraday to a high of ₹145.70, signalling confidence in the firm’s growth trajectory post-IPO.

“The first quarterly results after our IPO reflect disciplined execution and strong market response,” said a company spokesperson. “We remain focused on scaling our offerings and diversifying into new segments to ensure sustainable long-term growth.”

PhysicsWallah is increasingly moving beyond its traditional test-prep courses for exams such as JEE and NEET, exploring additional categories to broaden its revenue base. The company expects to turn full-year profit in FY27 as new online segments mature and offline centres stabilise.

With strong revenue growth, expanding user base, and robust cash flow, PhysicsWallah is positioning itself as a leading hybrid education provider in India. Market analysts noted that while the current quarter’s performance is encouraging, execution will be key as the company scales further.

Also Read: Blinkit CEO warns fast-delivery boom faces reality check