India’s Smartphone Shipments Jump 7.3% in Q2, Ending Two-Quarter Decline

Nearly half of all smartphones shipped in Q2 were 5G-capable, reflecting a clear shift in consumer preferences.

India’s smartphone market witnessed a strong rebound in the April–June quarter of 2025. Shipments rose 7.3% year-on-year, ending a two-quarter slump, according to market research firm Canalys. The growth came despite global economic uncertainties and intense competition among handset makers.

The report attributed the surge to improved consumer sentiment and seasonal promotions. Many brands adopted aggressive pricing strategies to clear older inventories and push new launches. Strong performance in online sales channels and a steady demand for mid-range devices also contributed to the upswing.

Xiaomi regains top spot

Xiaomi regained its position as the market leader with 15% market share. The company shipped 6.4 million units in Q2. Its Redmi Note series continued to drive volumes, supported by heavy online discounts and strategic partnerships with e-commerce platforms.

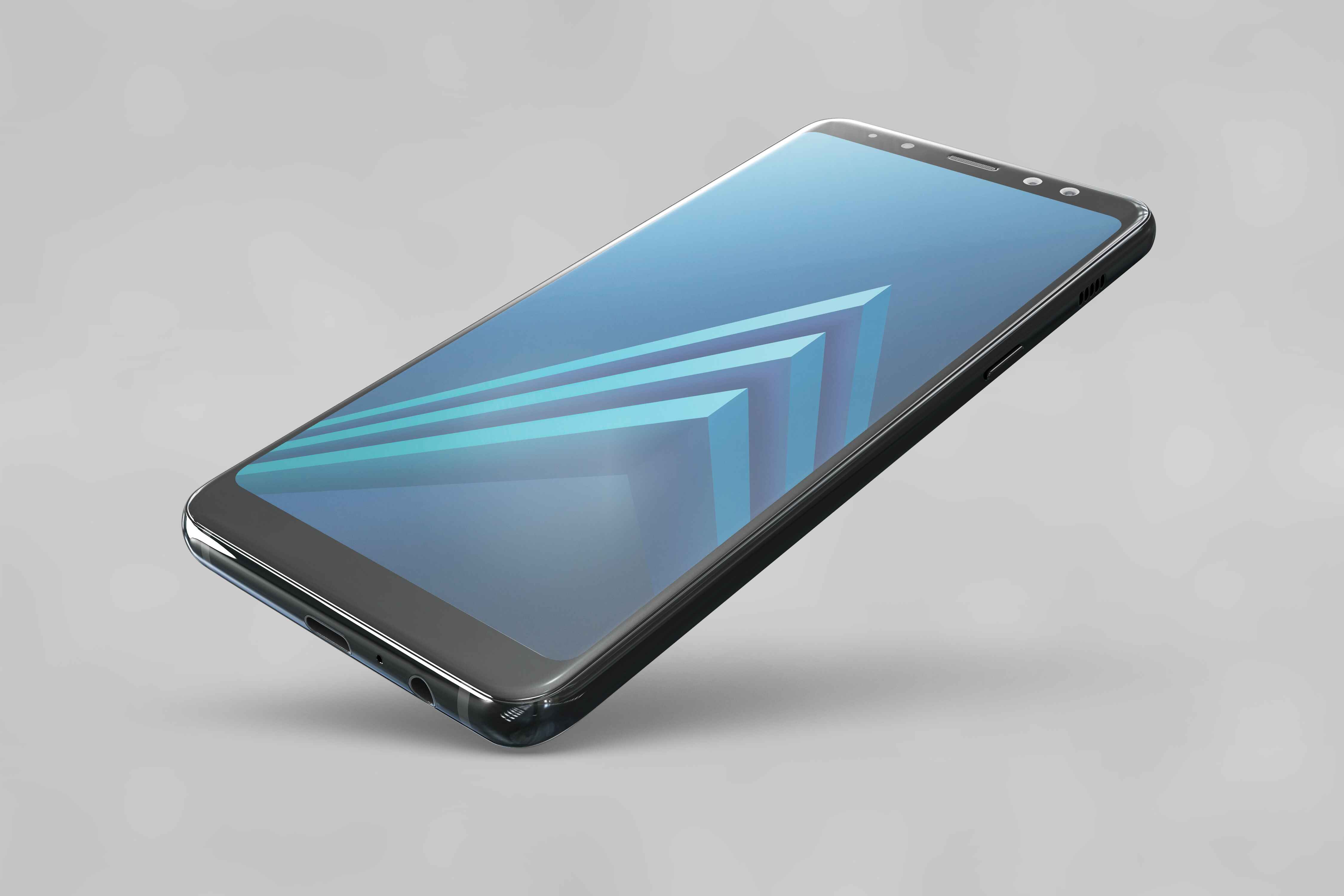

Samsung secured the second position with a 14% share and 6.1 million units shipped. The Galaxy A-series and M-series devices remained popular, offering a balance of price and performance.

Vivo followed with a 13% share, shipping 5.7 million units. The brand benefited from strong offline distribution and marketing campaigns targeting tier-2 and tier-3 cities.

Realme and Oppo rounded off the top five with 12% and 10% market shares, respectively. Both brands leveraged festive offers and promotional bundles to boost sales.

5G devices drive demand

Canalys noted that demand for 5G-enabled devices played a key role in the recovery. Nearly half of all smartphones shipped in Q2 were 5G-capable, reflecting a clear shift in consumer preferences. Telecom operators’ continued expansion of 5G coverage further fueled adoption.

“5G readiness has become a decisive factor for buyers,” said Canalys Research Analyst Ashweej Aithal. “Brands that can provide affordable 5G options without compromising on core specifications are seeing significant traction.”

Competition to intensify

Analysts expect competition to heat up in the second half of 2025. Several brands are preparing for major product launches ahead of the festive season. The market is also seeing increased activity from emerging players looking to carve out niche segments.

However, the report cautioned that challenges remain. Fluctuating currency rates, global supply chain constraints, and potential inflationary pressures could affect pricing strategies. Brands may need to balance affordability with profitability in the coming quarters.

Market outlook

The growth in Q2 marks a notable shift after two consecutive quarters of decline. In the January–March period, shipments had dropped 8% year-on-year due to weak consumer demand and excess inventory.

With Q2’s rebound, analysts are cautiously optimistic about the year ahead. They expect steady growth driven by 5G adoption, competitive pricing, and wider availability of financing options. The back-to-school and festive sales periods are likely to be key growth drivers for the remainder of the year.

As brands continue to battle for market share, consumers stand to benefit from better deals, more product choices, and faster technology adoption.